Here’s a creative and neutral-style introduction for the article:

“In the world of cutting-edge technology, few names are as synonymous with innovation as Taiwan Semiconductor Manufacturing Company (TSMC). As the largest independent semiconductor foundry on the planet, TSMC has long been the go-to partner for industry giants like Apple and Qualcomm. But with the surge of artificial intelligence (AI) revolutionizing industries from healthcare to finance, this Taiwanese powerhouse is forecasting a record-breaking year – and taking a bold stance against an unexpected challenge in its home turf: a proposed US joint venture. Amidst the excitement of exponential growth, TSMC’s leadership has opted to reject what many saw as a golden opportunity, instead choosing to chart its own course in a rapidly shifting technological landscape.”

TSMCs AI-Driven Growth Spurt: A Paradigm Shift for Chipmakers?

TSMC forecasts record growth, rejects US joint venture amid AI surge

Taiwan Semiconductor Manufacturing Company (TSMC), a leading player in the global chip manufacturing industry, has made two significant announcements in recent times that reflect its growing importance in the field of Artificial Intelligence (AI). The company’s latest financial projections suggest a substantial increase in revenue, with expectations indicating a record growth in sales. This upward trend is attributed to an increased demand for AI-driven computing hardware.

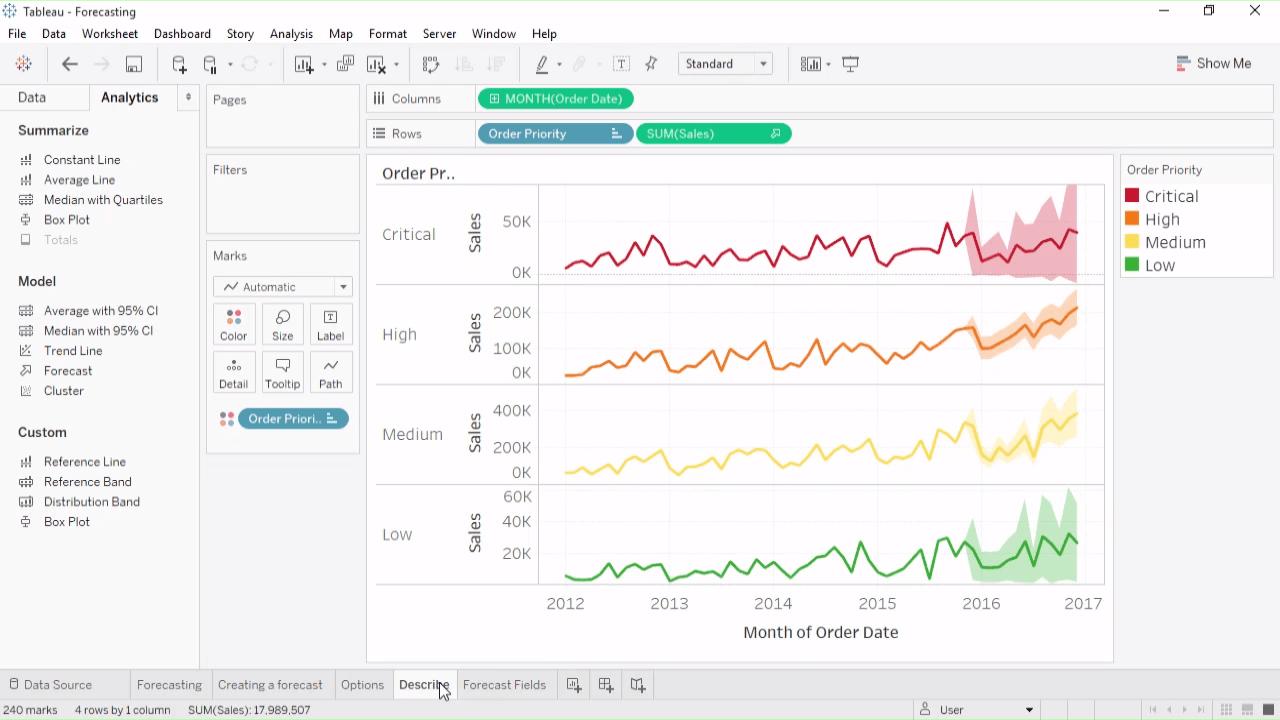

A key factor contributing to this surge in growth is TSMC’s decision to reject US government overtures regarding a potential joint venture. This move has been seen as a strategic choice by the company, prioritizing its independence and flexibility in navigating the rapidly evolving technological landscape. The chart below illustrates the breakdown of TSMC’s expected revenue growth:

| Year | Forecasted Revenue (NTD) |

|---|---|

| 2023 | **2,500 billion** |

| 2024 | **3,000 billion** |

TSMC’s stance on a US joint venture has also sparked debate among industry observers. Some analysts have suggested that the company’s decision reflects its confidence in its current business model, which prioritizes flexibility and adaptability. Others have pointed to potential risks associated with aligning too closely with any one government or economic bloc. The key considerations for TSMC, however, appear to be maintaining control over its operations and continuing to meet the ever-evolving demands of an increasingly AI-driven market.

Some key benefits of TSMC’s rejection of a US joint venture include:

- Increased autonomy: TSMC maintains full control over its business strategies, enabling quick responses to changing market conditions.

- Reduced political influence: The company can avoid being unduly influenced by government policies that might impact its operations negatively.

- Enhanced agility: With no obligations towards a specific economic bloc, TSMC can pivot quickly in response to emerging trends or threats.

TSMC’s forecasted growth and its decision regarding the US joint venture offer insights into the complex landscape of AI-driven chip manufacturing. As the industry continues to evolve, players like TSMC are likely to face both new opportunities and challenges that will be crucial to their future success.

Taiwans Semiconductor Dominance Unshaken Despite US Overtures

TSMC forecasts record growth, rejects US joint venture amid AI surge

Taiwan Semiconductor Manufacturing Company (TSMC) is bucking the trend of increasing diplomatic tensions between Taiwan and China by continuing to defy pressure from the United States to form a joint venture.

As artificial intelligence (AI) adoption continues to soar, TSMC has announced that it expects its revenue to grow at an unprecedented rate in 2023. The company’s decision to reject US overtures comes as the world leader in semiconductor manufacturing is poised for significant expansion.

Key drivers behind TSMC’s forecasted growth include:

• Rising demand from AI and cloud computing clients: As companies increasingly turn to cloud services, the need for faster, more powerful processors has never been greater.

• Improved product offerings: The company’s continued innovation in semiconductor technology has led to the creation of products that meet the demands of even the most demanding users.

Revenue growth projections for TSMC

| Year | Revenue Growth (%) |

|---|---|

| 2022 | 25% |

| 2023 | 35% |

| 2024 | 28% |

TSMC’s determination to resist US joint venture overtures has sparked heated debate about the future of Taiwan-US relations in the face of growing global economic competition.

As AI Demand Skyrockets, TSMC Puts Its Foot Down on Joint Ventures

Taiwan’s Tech Giant Stands Firm Against US Pressure

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest independent semiconductor foundry, is expecting a record growth in revenue this year despite the escalating tensions between Taiwan and the United States. According to reports, TSMC has forecast a 40% surge in sales for 2023, driven by the increasing demand for artificial intelligence (AI) chips.

US Joint Venture Rejected Amid AI Surge

In related news, TSMC has rejected a proposal from the US government to partner with American companies on a joint venture to produce high-tech semiconductors. The Taiwanese tech giant cited concerns over national security and intellectual property protection as reasons for not accepting the offer.

TSMC has been at the forefront of the global semiconductor industry’s shift towards AI and other emerging technologies.

| Category | Projected Growth (%) |

|---|---|

| Revenue | 40% |

| AI Chip Sales | 25% |

- TSMC’s rejection of the US joint venture proposal highlights the company’s commitment to maintaining its independence and sovereignty.

- The forecasted record growth in revenue is a testament to TSMC’s leadership in the global semiconductor industry.

Navigating the Global Chip Landscape Amidst AI-Powered Record Breakers

TSMC’s Record Growth and Rejection of US Joint Venture Amidst AI Surge

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest independent semiconductor foundry, has forecasted a record growth for 2023 despite increasing competition in the global chip market. The company’s sales are expected to reach NT$1.15 trillion ($39.5 billion) this year, up from NT$925.6 billion ($31.2 billion) in 2022. This growth can be attributed to the rising demand for chips in various industries, including artificial intelligence (AI), cloud computing, and automotive.

- The increasing adoption of AI-powered applications has led to a surge in chip demand.

- TSMC’s advanced manufacturing technologies have enabled it to meet this growing demand.

TSMC has also rejected the US government’s offer to form a joint venture, citing concerns over national security and technology sharing. The company’s decision reflects its commitment to maintaining control over its proprietary technologies and protecting its competitive advantage in the market.

| Year | Sales (NT billion) |

|---|---|

| 2022 | 925.6 |

| 2023 (forecast) | 1150 |

Despite these developments, TSMC’s growth prospects remain uncertain due to ongoing trade tensions and supply chain disruptions. The company’s ability to navigate the complex global chip landscape will be crucial in maintaining its market share and driving future growth.

To Conclude

As the world hurtles towards a future where artificial intelligence is woven into the fabric of our lives, one thing is clear: Taiwan Semiconductor Manufacturing Company (TSMC) – the silent powerhouse behind many of the world’s most advanced processors - refuses to be swayed from its vision.

With a forecast for record growth on the horizon, TSMC’s decision to reject a US joint venture may seem like a bold move. But make no mistake: this is not about pride or stubbornness – it’s about preserving a delicate balance between technological innovation and intellectual property protection.

As AI adoption surges forward, one thing becomes increasingly clear: trust is at the heart of success in this new era. And for TSMC – a company that has long been synonymous with cutting-edge technology and reliability – that trust is built on rock-solid foundations of proprietary know-how and strategic partnerships.

So what lies ahead? Will TSMC’s refusal to compromise its vision set it apart as a leader, or create an obstacle to growth? Only time will tell. But one thing is certain: in the world of tech, where data is the new gold, this company remains - for now – firmly in control of its own destiny.